Credit card are most effective option to tackle financial difficulties, and during the outbreak that was sweeping the country, banks were handing their credit cards at no cost. However, many people don’t have a credit history or are in a negative situation, which makes it extremely difficult to obtain credit cards. But don’t worry as there is still an option like https://www.milestonegoldcard.com/home where it is quite easy to get a credit card.

However, do you think that applying for a credit card that has poor credit background is a wise choice? Let’s find out whether the people of the USmust opt for an Milestone Card or not.

What is a Milestoneapply Com?

Many banks today are giving credit cards to help manage financial difficulties. Milestone is an financial website that issue master cards to customers in the United States. Milestone has partnered on behalf of the Bank in the US by which credit cards are issued and distributed to individuals. Anyone with a poor credit history can also get the card.

Its website Milestoneapply.com is legitimate however, it doesn’t reveal their charges clearly. From reviews, Milestone charges a significant processing fee as well as an interest rate, which makes the payment difficult cardholders.Milestoneapply Com

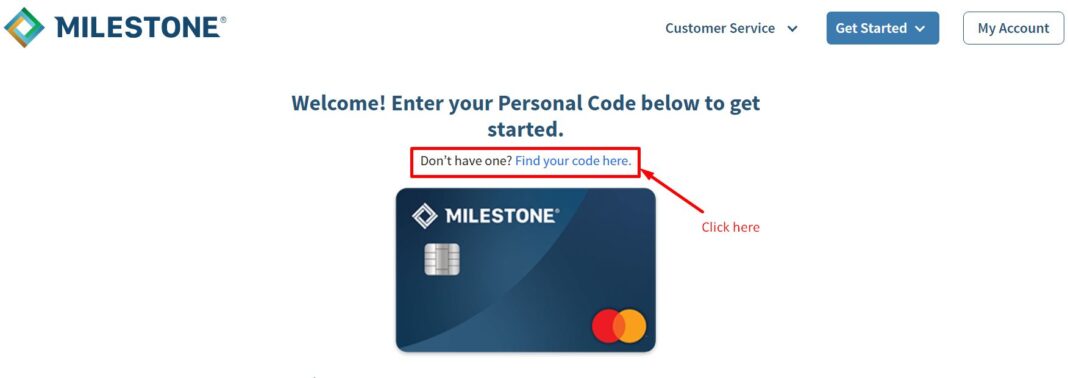

The company requires mail to customers who have their milestoneapply.com private code to be able to apply for the card, which isn’t an excellent indicator. People who need money and are looking for a credit card should be sure to verify every detail prior to applying via Milestone.com.

Why opt for Milestone Mastercard?

In the case of the Corona-19 pandemic numerous banks provide credit card however, certain aspects will make you think of Milestone Mastercard’s. A few of the advantages of Milestoneapply are as the following:

- Bankrupts or those who suffer from an poor credit score can also obtain credit cards from Milestone. When a pandemic struck, lots of individuals lost their jobs and went bankrupt, the choice of Mastercard could make it much easier to manage your finances.

- Someone who requires additional credit can seek help from the business. It is indeed possible to obtain credit above the allowed limit in real-world situations.

- The Milestone Mastercard is safe and safe from all fraudulent activities including theft, stealing and theft. So, you’re secure when it comes to getting credit.

- The whole process of getting a credit card is simple and anyone can apply for a credit card to control their finances. The activation procedure is simple and fast.

- Cardholders have access to their accounts 24/7. Additionally there is no requirement for a security deposit in order to obtain the card with no collateral.

Why should you avoid Milestone Mastercard?

The bank that is registered in Missouri issues the Milestone Mastercard. A lot of people from the US have made an application for the credit card, and received their personal codes via email. The majority of people use Milestone credit cards to manage their finances. Milestone credit card in order to control their finances However, many charge excessive interest rates and annual charges.

Furthermore, those who have a poor credit score can also be eligible for credit cards which makes the website untrustworthy. Anyone with bad credit scores or who are in bankruptcy aren’t suitable for credit cards however Milestone provides them with cards. There are some negative reviews and customers aren’t happy with the service.

People often do not consider other aspects this is the reason they have to pay an additional processing fee and annual costs. All in all, Milestone Mastercard will not solve your financial problems butin the long run will only raise it.

FAQs

Which bank issue Milestone Mastercard?

Milestone issue cards through The Bank of Missouri, an FDIC-insured commercial bank. The bank is located in St. Robert, the city located in Missouri, US.

What’s a milestoneapply private?

Someone that receives post through The Milestone firm, is going to receive the official link as well as the personal code that is unique to you. When you click the link you will be directed onto the Milestone official website and where the personal and zip code must be entered. You will then need to fill out the application for you to complete the form.

Conclusion

The company provides a credit card for people with a poor credit histories, but the charges are high and make it hard to deal with the financial strain. Therefore, those who find it difficult to handle their financial issues and are looking for a credit line should be wary of a to use the card offered by Milestone. Would you consider examining thoroughly prior to you apply to the Milestone card in order to avoid any future problems?